BA Solutions Overview

Every day, MSA's Business Analysis (BA) division's custom analytics help Consumer Packaged Goods (CPG) companies and those from many other industries gain the insights they need to forecast, budget, market, solve complex challenges and grow.

Every day, MSA's Business Analysis (BA) division's custom analytics help Consumer Packaged Goods (CPG) companies and those from many other industries gain the insights they need to forecast, budget, market, solve complex challenges and grow.

We work across virtually all industries, using advanced analytical techniques, along with tried-and-true methods, to provide clients with unparalleled answers to their most pressing questions. We provide a level of problem solving that just can't be achieved with off-the-shelf solutions.

Direct Marketing Program Management for Arts and Culture Organizations

What we do

Since early 2021, Management Science Associates, Inc. (MSA) has been providing several arts and culture organizations with a complete Direct Marketing (DM) program management solution. While every DM program management solution MSA implements for an arts or culture organization is unique, a key element is always analytics-driven DM campaign files for subscription acquisition or single ticket sales for an upcoming season, performances or events.

How we do it

MSA first integrates multiple data sources into a separate, central DM database. Having an independent database managed by MSA is important since it often contains prospect list data provided by other arts and culture organizations. The client's own customer data, including historical subscription and ticket sales data, is also a key input. When needed, MSA can utilize its proprietary merge-purge algorithm to identify any duplicate individuals or households. With the help of a third-party service, MSA can also append granular demographic data to the database households, in order to account for more factors in the analysis.

MSA then conducts data mining and exploration on the integrated datasets to determine the most appropriate analytical methodology to identify which prospects will most likely respond to a particular DM campaign. Variables in MSA's custom models often encompass demographic and behavioral factors, geography, and traits of the prospect lists obtained. When available, the prospects' detailed purchase history can be accounted for in the models.

From the central DM database, MSA then periodically pulls DM campaign mail files and provides them directly to an organization's printer/mail house. Before delivering each mail file, MSA standardizes addresses, runs NCOA, and excludes records as needed, such as those on a Do Not Contact list.

What data is required?

Prospect data is obtained either via third-party services or lists share/trade agreements with other arts and culture organizations. An organization's own historical sales data is often provided as file extracts from the organization's Tessitura database.

Read a Direct Marketing Program Management for a Performing Arts Organization success case study.

Mobile Couponing for Direct Marketing

What we do

Management Science Associates, Inc. (MSA) has been providing clients with a complete Direct Marketing (DM) Program Management solution for many years. Until recently, the programs have focused mainly on sending out traditional, paper DM mailers to select consumers from large opt-in databases owned by those clients. Now, MSA has developed and implemented new Mobile Couponing features to our solution so as to enhance coupon redemptions among consumers.

How we do it

MSA's approach to Mobile Couponing was to add both mobile coupon websites and a geo-based mobile coupon app to its Direct Marketing solution. This allows for consumers to initiate digital coupon access and usage two ways:

- Mobile coupon website – consumers are informed of the URL/link to a Client's custom mobile coupon website, as well as the frequency of coupon offers. Then at the consumer's discretion, they access the website anytime via their smartphone's web browser, and login with their email-ID and password.

- Mobile coupon app – consumers download a Client's custom mobile coupon app to their smartphone. They then access the app anytime, and login with a PIN number.

MSA's Mobile Couponing solution has several key features and functions:

- Multiple digital coupon offers can be provided each week to preregistered consumers, redeemable at participating retail outlets. The participating retail outlets list can be updated as often as desired.

- Once a consumer accesses either a Client's mobile couponing website or mobile coupon app, they are presented with a list of digital coupons being offered to them.

- If they select a digital coupon they want to redeem, they are presented with a list of nearby accepting retail outlets. The retail outlet list is served based on the consumer's smartphone's current geolocation and only those within a defined radius (e.g., within a half-mile).

- If they select a retail outlet where they want to redeem the digital coupon, the consumer is given the option to 'redeem now' within a specified number of minutes (e.g., 8 minutes).

- If they press 'redeem now', they are presented with the actual digital coupon with a barcode to present to the selected retailer's checkout before the timed offer expires.

- The app also has a cool image recognition feature that can be used as an alternative to scanning a long list of digital coupons being offered to them. Designed to be used in-store, all the consumer has to do is 'hover' their smartphone's camera over a product they are interested in buying. The app will then search the Client's DM database for any available coupons for that product, even if it is a competitive brand. This latter case is for trying to encourage brand switching.

What is required?

MSA's Mobile Couponing websites and app are compatible with both iPhone ® and Android ® smartphones.

Read a Mobile Couponing success case study.

All product names, trademarks and registered trademarks are the property of their respective owners.

See how consumers interact with MSA's Mobile Couponing app on their smartphones.

Out-Of-Stock (OOS) Prevention for Retailers

What we do

There is often significant lag time from when an Out-Of-Stock (OOS) product is identified and when the product can be restocked. This causes Retailers to lose potential sales. OOS product is one of the most difficult challenges for Retailers to combat since store sales cycles for most products rarely follow a consistent, easy to anticipate trend. Even obtaining accurate inventory counts can be a challenge for Retailers, so much so they sometimes receive 'phantom inventory' counts.

Until recently, the most common solution offered to Retailers has been 'estimates' as to when a product in certain stores is going to be OOS. However, these approaches have often proven to be inaccurate and unreliable.

Until recently, the most common solution offered to Retailers has been 'estimates' as to when a product in certain stores is going to be OOS. However, these approaches have often proven to be inaccurate and unreliable.

As an alternative, Management Science Associates, Inc. (MSA) works with Retailer clients to provide them with a more accurate method of identifying if a product in any of its locations is heading towards being OOS with enough advanced warning that it can be reordered before it does so, thus avoiding any missed sales opportunities.

How we do it

When analyzing historical retail sales, orders and shipments data, MSA noticed that OOS situations often occur after there is unusual consistently high sales for a product at stores, but with no adjustments made to the reorder quantity or frequency for that product. Sales outpaced shipments during these high sales periods, and this resulted in the product having no sales in later periods.

We also noticed higher than usual reordered quantities and 'reactive shipments' made to stores after the OOS situations occurred in response. These reactive shipments did not solve the problem, however, since the stores had already lost sales for the product and possibly lost customers when it was OOS.

Based on our analysis, MSA recognized that what Retailers really needed was an accurate early warning measurement that could be used as a 'proactive alert'. Therefore, we created a new actionable measurement that we send directly to Retailer clients along with a suggested reorder quantity to prevent product availability challenges in the near future.

MSA tracks the measurement for our Retailer clients and flags for them the stores and products that at some point in the future will become OOS if no correction is made. The Supply Chain Teams along with the Store Managers can then make the necessary reorder adjustments to prevent a future OOS.

What data is required?

This solution requires a couple of key retail datasets: store-level Point-Of-Sale (POS) or Retail Scan Data (RSD), as well as store-level shipments or product delivery data.

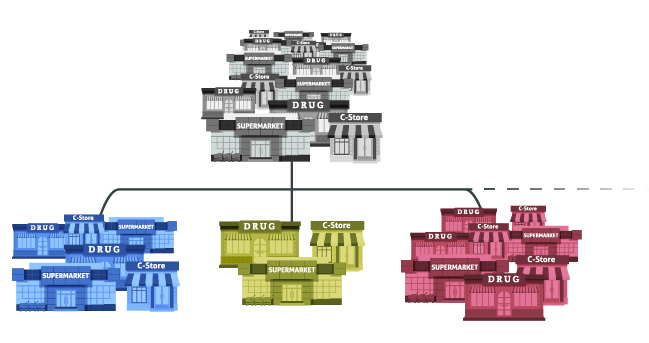

Retail Store Segmentation

What we do

MSA provides clients with a holistic analysis of their total retail environment so as to optimize their distribution networks, brand mixes at stores, sales force deployments and new product introductions, all with the sole purpose of maximizing brand sales.

How we do it

We use a 'clustering' technique to identify distinct groups of stores (or 'clusters') based on equivalized store sales and consumer demographics data. More specifically, we often use a 2-stage algorithm methodology whereby clusters are created such that stores within a cluster are as similar as possible, while differences between the clusters are significant:

Outputted clusters are then turned into actionable information:

- Profiles of each cluster created based on key metrics

- Clusters ranked based on their potential sales value for your brands

- The most promising markets identified for where to deploy your sales force

- Store potential 'call lists' created for your sales force

What data is required?

Distributor shipments or retail store sales data, such POS scanner data, as well as publicly accessible consumer demographics data, such as from the US Census Bureau.

Retail Analytics

What we do

Management Science Associates, Inc. (MSA) works with clients to maximize their brand sales through optimizing the distribution of the right products, to the right places, with the right amount of marketing support, for all retail environments.

How we do it

MSA implements a myriad of methodologies to achieve clients' product distribution and sales goals:

- Product Assortment Optimization – group retail outlets with similar performance dynamics and then identify which brands are contributing to the majority of sales within each group, while excluding those that have only marginal contributions to sales.

- Retail Segmentation – group similar market or customer entities to facilitate efficient and effective implementation of distribution, tactical trade promotion (i.e., TPO) and in-store communication initiatives.

- Store Layout Optimization – using our proprietary Store Feature Measurement Tool, estimate impacts on brand and category sales based on changes to a multitude of business driving elements; store location, assortment quantity and quality, main location facing, category layout and product placement, and even secondary product placement.

- New Product Introduction Analytics – for either new products or line extensions, simulate forecasts of sales volume and market share performance, including any impacts from cannibalization, as well as distribution growth and acceptance estimates, including identifying distribution gaps and opportunities.

- Twitter Followers Segmentation – using our proprietary technique, gain a better understanding of consumers' attitudes and usage of brands, as well as their buying habits, based on their social media comments and activities on this major platform.

What data is required?

These approaches offer the great flexibility of being able to use either Retail data; such as POS, distributor sales or shipment data, or Consumer data; such as from panels or surveys.

Marketing ROI Optimization

What we do

Management Science Associates, Inc. (MSA) works with clients to maximize their return on marketing investments: across markets, across a portfolio of brands, and across a myriad of diverse marketing activities. These activities can include trade promotions, traditional media communications, and digital and social media communications.

How we do it

MSA develops full Marketing Mix Models (MMM) for all brands within the scope of the analysis using what we describe as an artisan approach to model development. Our highly experienced and talented Analysts create all brand models from scratch, and then finely tune them by hand to completion. Our clients find that there are many advantages to taking an artisan approach for brand model development, versus using automated modeling tools or black box algorithms.

Secondly, we implement a unique, two-stage process to develop models:

- We first develop Stage 1 models to determine the interdependent effects of all paid media (traditional as well as digital and social media), owned (websites, Facebook sites, etc.) and earned media (organic search, website visits, etc.).

- We then develop Stage 2 models that are full marketing mix models to determine the impact of all factors on sales.

The final key component to MSA's solution for our clients is NaviGATE™, which is our cloud-based simulation and optimization application. With NaviGATE, we harness the explanatory and predictive power of marketing mix models to measure and optimize Marketing ROI: across markets, across a portfolio of brands, and across marketing vehicles. NaviGATE is technology that acts as an enterprise wide repository of analytical models, and allows for the ongoing utilization of marketing mix models.

Additionally, an alternative to analyzing full marketing mix models to measure the ROI of marketing investments is to apply them to conduct Base Sales Volume Analysis. The focus here is to clarify all of the non-marketing drivers of sales, such as seasonality and economic factors, as well as measure sales not affected over the short-term from marketing investments. This proportion of base sales is from loyal buyers; sales driven by brand equity.

What data is required?

Since the heart of this solution is the development of marketing mix sales models, historical sales data is required, along with data sets over the same period that represent the full marketing mix, including distribution, pricing, new product/service introductions, all promotional and communications activities, and consumer social media behaviors.

Price Promotion Optimization

What we do

Since pricing is one of the key marketing levers for almost all brands, Management Science Associates, Inc. (MSA) works with clients to help them better understand the effects of different price promotion strategies on brand sales. These studies typically focus on multiple geographical levels: nationwide, by region, by state, by county, etc. The resulting analysis leads to the implementation of optimal price promo strategies that maximize sales.

How we do it

MSA implements a three-phased approach to achieve clients promotional pricing goals:

- Phase 1: Develop price elasticity models to measure a brand's sensitivity to changes in price at various geographical levels. These models determine which geographic areas are more sensitive to price changes. They also help gauge future sales impacts to significant price changes.

- Phase 2: Develop price threshold models to understand at which prices do significant sales volume changes occur. In addition, there is distinction made between Base price elasticity (i.e., longer-term pricing impact) and Promoted price elasticity, which pertains to the impact of temporary price reductions.

- Phase 3: Using the Phase 2 price threshold elasticities, develop an optimization model to determine the most efficient spend (maximized volume while minimizing spend). Optimization is determined by using a simulation tool that MSA has created which applies this model by calculating the expected brand volume impacts of different discounted price values. Typical final output is optimal promotional price points for various geographical levels: nationwide, by region, by state, by county, etc.

What data is required?

This methodology uses POS Retail data.

Ticket Sales Forecasting

What we do

For over 10 years, Management Science Associates, Inc. (MSA) has been providing performing arts companies in the U.S. and overseas with ticket sales forecasts for their upcoming seasons. MSA's forecasts have proven to be highly accurate, leading to more effective budgeting and program analysis for these companies.

How we do it

While the initial data setup for each performing arts company is unique, key input variables for an upcoming season would include every planned performance date and time and their respective creative, as well as details on their subscription packages.

For a symphonic orchestra as an example, important creative details would include the names of conductors and the featured soloists, the soloists' instruments, and the composers of the performed works. Familiarity rankings for conductors soloists, composers and performed works are also included to differentiate their respective impacts.

MSA uses a proprietary simulation tool to determine total ticket sales forecasts for each performance, forecasting both subscriber and single ticket sales. The aggregate of all of the individual performance forecasts is the total upcoming season forecast.

What data is required?

This methodology uses historical ticket sales data and performance details from previous seasons.

Marketing Analytics Applications

What we do

Management Science Associates, Inc. (MSA) knows that some clients prefer to have access to analytical tools internally, rather than having to request outside suppliers for data output and answers every time there is a need. This is why MSA has taken some of its best marketing analytical tools and developed stand-alone applications for clients to manage and use on their own, in-house.

How we do it?

The stand-alone marketing analytics applications MSA offers to clients for their own, internal use on a cost-effective licensing basis are:

- Market Matching Analytical Tool – Offers a systematic selection of test and control pairs or groups using retail, consumer, physician, or patient data. This multiplicative model application utilizes the historical trend, variation, and level factors to compute a market similarity index. The application matches criteria based on a time series or a point-in-time.

- MAID (Multivariate Automatic Interactive Detector) – Segmentation Analysis using retail or consumer data. This modeling application provides hierarchical segmentations using multiple dependent variables.

- SAGE (Share And Growth Evaluation) – Market Share Analytics via source of volume analysis using retail or consumer data.

- Market Impact – Concept Testing analysis using consumer survey data for new product forecasting.

- Store Feature Measurement Tool – Store Layout Optimization by providing estimated impacts on brand and category sales based on changes to a multitude of business driving elements; store location, assortment quantity and quality, main location facing, category layout and product placement, and even secondary product placement.

What data is required?

Many of these applications offer the great flexibility of being able to use Retail data; such as POS, distributor sales or shipment data, Consumer data; such as from panels or surveys, or Physician and Patient data.